We have yet to see more data in the upcoming months to quantify the effect of Covid-19 on local real estate. The initial data from online platforms indicate a surge in demand for real estate in the U.S. This will likely wear off though as we continue to face the uncertainty of these crises.

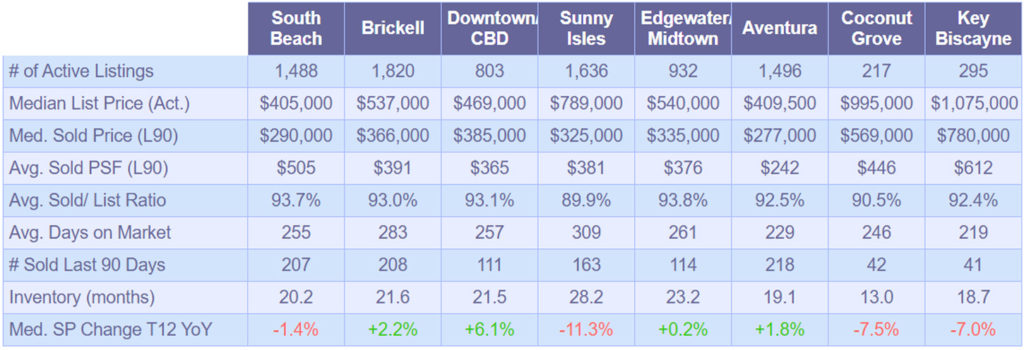

The number of active condominium listings decreased in all eight markets compared to a year ago by an average of 7.8%. The largest decreases have taken place in Edgewater (-15.4%), South Beach (-13.5%), Coconut Grove (-11.8%) and Brickell (-10.4%).

Median asking prices do not show significant variances from a year ago except Downtown with an increase of 6.6% from $440,000 to $469,000 and Edgewater with a drop of 3.6% from $560,000 to $540,000.

Compared to 12 months ago, the median sold prices increased the most Downtown with a jump of 16.2% from $331,250 to $385,000 followed by Key Biscayne with 12.8% from $691,250 to $780,000. On the opposite end is Sunny Isles Beach with a 15.3% plunge from $383,500 to $325,000.

Inventory level is a function of available condominiums for sale and sale velocity during a period of time, which in our calculations is the last 12 months. Inventory levels dropped across all markets except Aventura where it remained unchanged compared to a year ago. The largest decrease has been taken place in Edgewater where the level plummeted by 32.9% and it would take currently 23.2 months to sell off the current inventory. It is followed by Coconut Grove (-23.1%), Sunny Isles Beach (-18.7%), Brickell (-14.3%), and South Beach (-13.7%).

Data Source: SEF MLS, March 19, 2020

Sign up for our Monthly Market Snapshot here or contact us for further information.

12 Comments