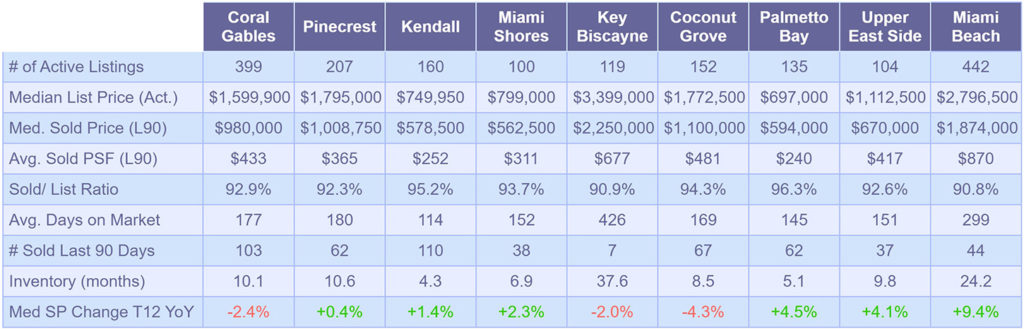

A number of active listings hold more or less the same compared to a month ago but are significantly lower in all surveyed markets compared to a year ago. The largest active listings reductions have taken place in Coconut Grove (-24.4%), Palmetto Bay (-20.1%), Upper East Side (-20.0%), and Kendall (-19.6%).

Compared to a year ago, the median asking price climbed the most in Coconut Grove 10.8% (from $1,600,000 to $1,772,500) but as you can see in the next paragraph it also experienced the largest drop. Miami Beach has experienced a bump of 7.9% (from $2,592,500 to $2.796,500) followed by Upper East Side with an increase of 5.4% (from $1,055,250 to $1,112,500).

Coconut Grove had the poorest performance of the last 90-day median sale price year-over-year with a 12.0% drop from $1,250,000 to $1,100,000. It was closely followed by Upper East Side with a decrease of 10.5% from $749,000 to $670,000 and Key Biscayne with a 7% dip from $2,420,000 to $2,250,000. Same as in the last month’s report, the frontrunner in the positive spectrum is once again Miami Beach. The last 90-day median sale price year-over-year shot up 53.3% from $1,225,000 to $1,874,000. The average price per square foot is up 27.6% from $682 to $870 in Miami Beach during the same period.

The largest reduction of inventory levels took place in Coconut Grove from 12.2 to 8.5 months, followed by Upper East Side from 13.1 to 9.8 months, Kendall with a drop from 5.6 to 4.3 months, and Palmetto Bay where the inventory was reduced from 6.4 to 5.1 months. Kendall, Palmetto Bay, and Miami Shores are neighborhoods with the tightest inventory supply.

Sign up for our Monthly Market Snapshot here or contact us for further information

Data Source: SEF MLS, February 19-20, 2020

17 Comments